Case Study: AI Chat for Mortgage ProfeSSIONALs

An enterprise UX research and design project

Overview

The problem: Finding the perfect loan for each client can be a challenge for mortgage professionals. They face outdated tools, time pressure, and the burden of building trust with clients, often faced with complex scenarios they have never seen.

The solution: An AI-powered loan assistant that cuts through the complexity. This case study dives into my team’s journey, where I led user research and design strategy to define user needs and guide product decisions.

The result: A dynamic experience that empowers mortgage professionals to:

Quickly find answers to complex loan scenarios

Build stronger relationships with clients through personalized interactions

Save time and improve efficiency

Timeline: July–December 2023 (Q2-Q3)

Discovery phase

To tackle user challenges in loan origination, I first mapped the landscape. This involved:

Defining key user problems: Through brainstorming, I identified areas for research and corresponding questions to understand the specific challenges faced by bankers and operations teams. My focus was on separating problems perceived by business stakeholders and focusing on problems faced by our end user.

Competitive analysis: I compared existing generative AI tools used in similar contexts, highlighting their strengths and weaknesses.

Literature review: I led a team effort to gather the latest insights on machine learning and generative AI, consulting academic journals, Nielsen Norman Group, and Gartner for Technical Professionals. Additionally, I facilitated a meeting with a Gartner consultant to gain deeper understanding of AI product architecture.

Outlining problems, questions, and possible research methods

Persona Creation

Through in-depth shadowing of bankers, I spearheaded the creation of a primary persona capturing their needs and habits. We observed their interactions with enterprise apps, including the loan origination system, and their search behaviors for guideline information, both with and without clients on the phone.

User Persona

Our primary persona created shared understanding and empathy among the project team.

Stakeholder ALignment

Whiteboarding during a workshop with stakeholders

To bridge the gap between user needs and business goals, I led a discovery workshop with senior leaders, using our primary persona as the voice in the room. Through a whiteboarding exercise we generated impactful user stories like “As a banker or underwriter, I need assistance quickly so that I can keep the loan moving.”

The workshop yielded three critical decisions that set the project's direction:

Chat as the priority channel: Redirect volume to chat to handle routine queries, reserving phone calls for complex scenarios.

Loan-level expertise: Equip our chat tool to confidently answer all loan-level questions, eliminating the need for external research.

Quick answers: Provide fast responses for straightforward questions, boosting banker efficiency and client satisfaction.

User interviews

Building on initial stakeholder alignment, I spearheaded a user interview study to delve deeper into user needs and inform our AI strategy.

Instead of assumptions about how AI might be perceived, I created key insights through targeted questions. "AI will be nice at a bigger level for qualifications and questions. I just don't know the value with it working with all our clients," said one banker.

Another participant described their approach to client relationships: “Clients are bought and sold on emotions. You have to gain them as more of a friendship."

People I talked to also expressed enthusiasm for AI's potential, but noted they are wary to fully trust AI-generated content. A big takeaway for our product team: People expect transparency through cited sources, so they can double-check the accuracy of information.

Experience Design

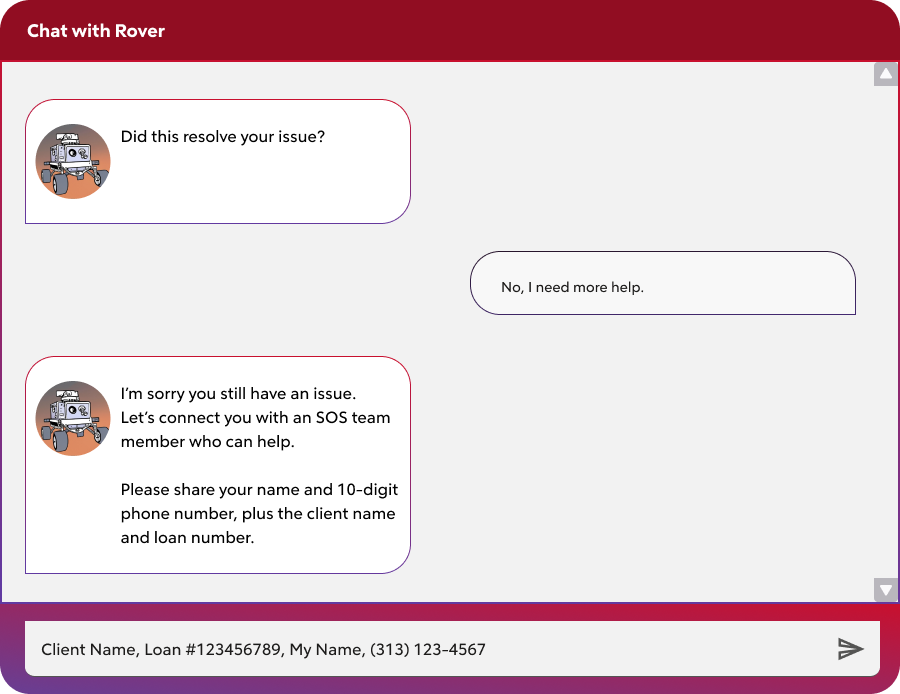

As the user narrative unfolded, our team gravitated toward a chatbot solution. To bring this vision to life, I crafted wireframes with a deliberate focus:

Clear user flows: Common scenarios that illustrate the path to resolve loan stoppers

Cohesive design: Components based on our company design system

Seamless integration: Ideas for how chat can supplement our existing search product

Impact

My research became actionable data to fuel our team's progress. These insights helped pave the way for an impactful design:

Transparency through citation: Present links to source guideline information, allowing users to verify answers and build trust.

Automate repetitive tasks: Free team members from data entry, empowering them to focus on building client relationships and emotional intelligence.

Personalized AI assistance: Tailor AI-generated responses to the specific needs and knowledge levels of different user roles - from mortgage bankers to underwriters and title coordinators.

Next Steps

This journey through user needs and AI possibilities didn't end with initial prototype. I have created a detailed testing plan that will help us refine the solution based on real-world interactions. Our testing goals are as follows:

Assess the chatbot’s ability to accurately identify issues and match them with quality solutions

Evaluate the effectiveness of the self-service process steps provided

Evaluate the perceived ease or difficulty using the chatbot interface

Gather feedback on user satisfaction with the overall experience